Businesses across industries are using increasingly complex analytics to power collection and recovery decisions. However, debt collection agency and legal agency placement processes remain limited in their use of analytical tools and capabilities. This results in generic, judgmental placement strategies, lacking a robust champion/challenger approach, with limited performance reporting and insights. This presents a big opportunity to make a clear differentiation, especially in markets where customers have multiple exposures to different lenders, and collection managers must fight for payments just as marketing fights for wallet share.

When analytical tools and techniques are used effectively, they empower a credit grantor’s agency management team to make data-driven strategic decisions and to hold more informed performance management discussions with their collection agencies. This approach typically results in portfolio performance improvements of 5%–10%, which can equate to millions of dollars in increased collections for the organization.

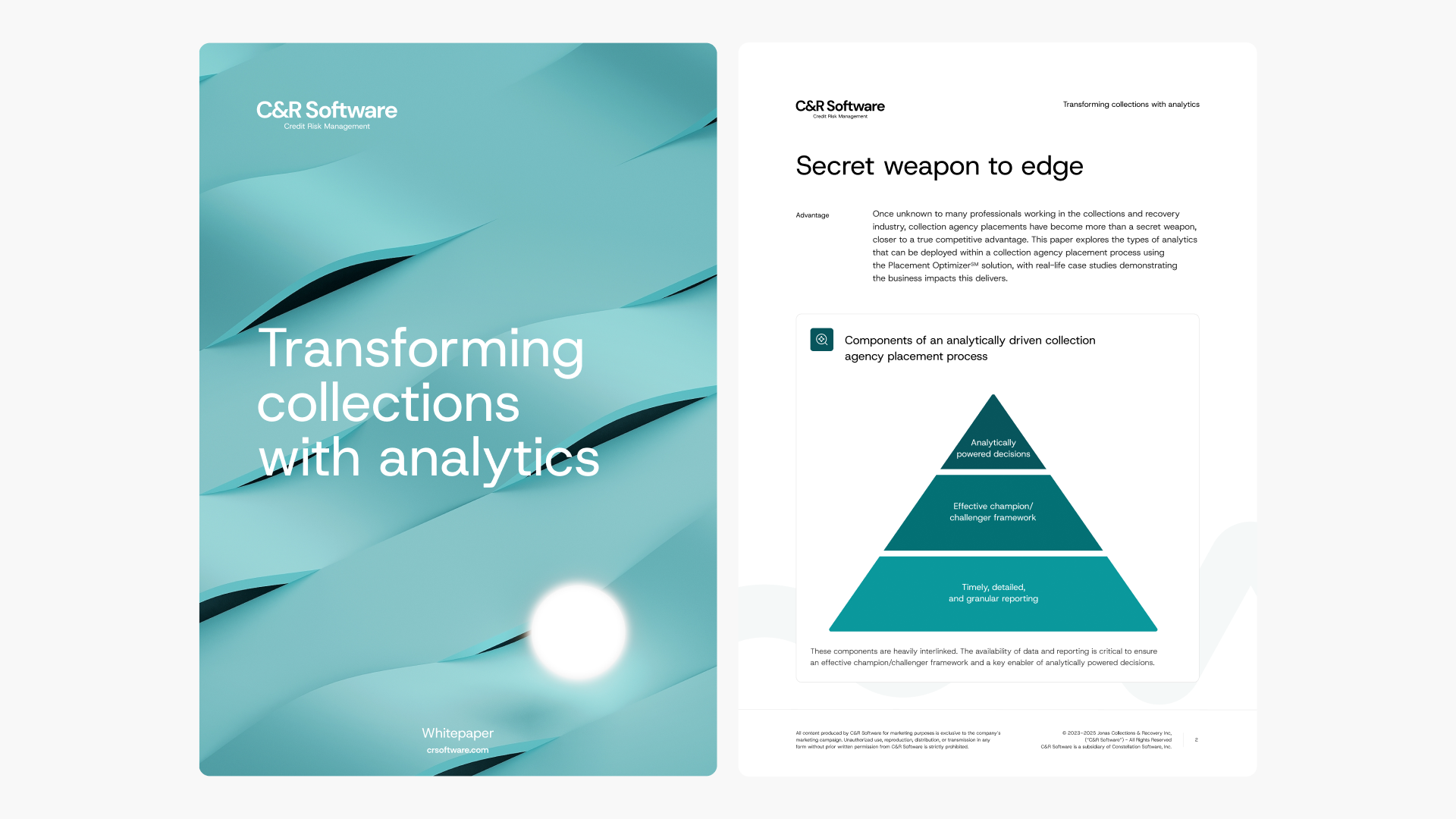

Once unknown to many professionals working in the collections and recovery industry, collection agency placements have become more than a secret weapon, closer to a true competitive advantage. This paper explores the types of analytics that can be deployed within a collection agency placement process using the Placement OptimizerSM solution, with real-life case studies demonstrating the business impacts this delivers.

-Jan-20-2026-02-48-49-6447-PM.png?width=352&name=operationalize%20AI%20(15)-Jan-20-2026-02-48-49-6447-PM.png)

-Jan-28-2026-02-16-48-0429-PM.png?width=352&name=operationalize%20AI%20(14)-Jan-28-2026-02-16-48-0429-PM.png)