In the modern collections landscape, you need to effectively manage data flows into your business, between your systems and out to third parties. That way, you can be sure that each of your processes hosts clean and high-quality data that result in accurate analytics and consistent customer experiences.

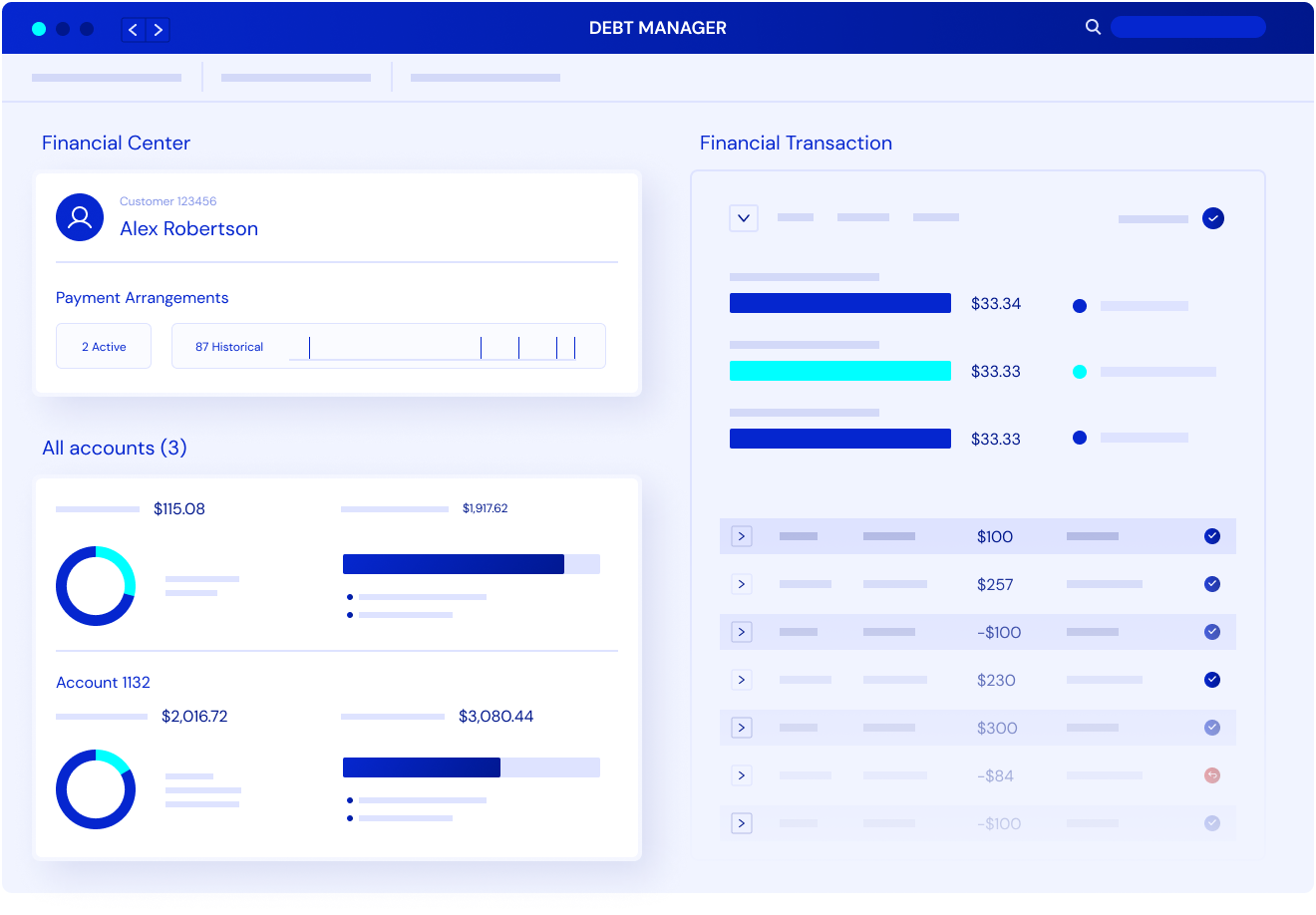

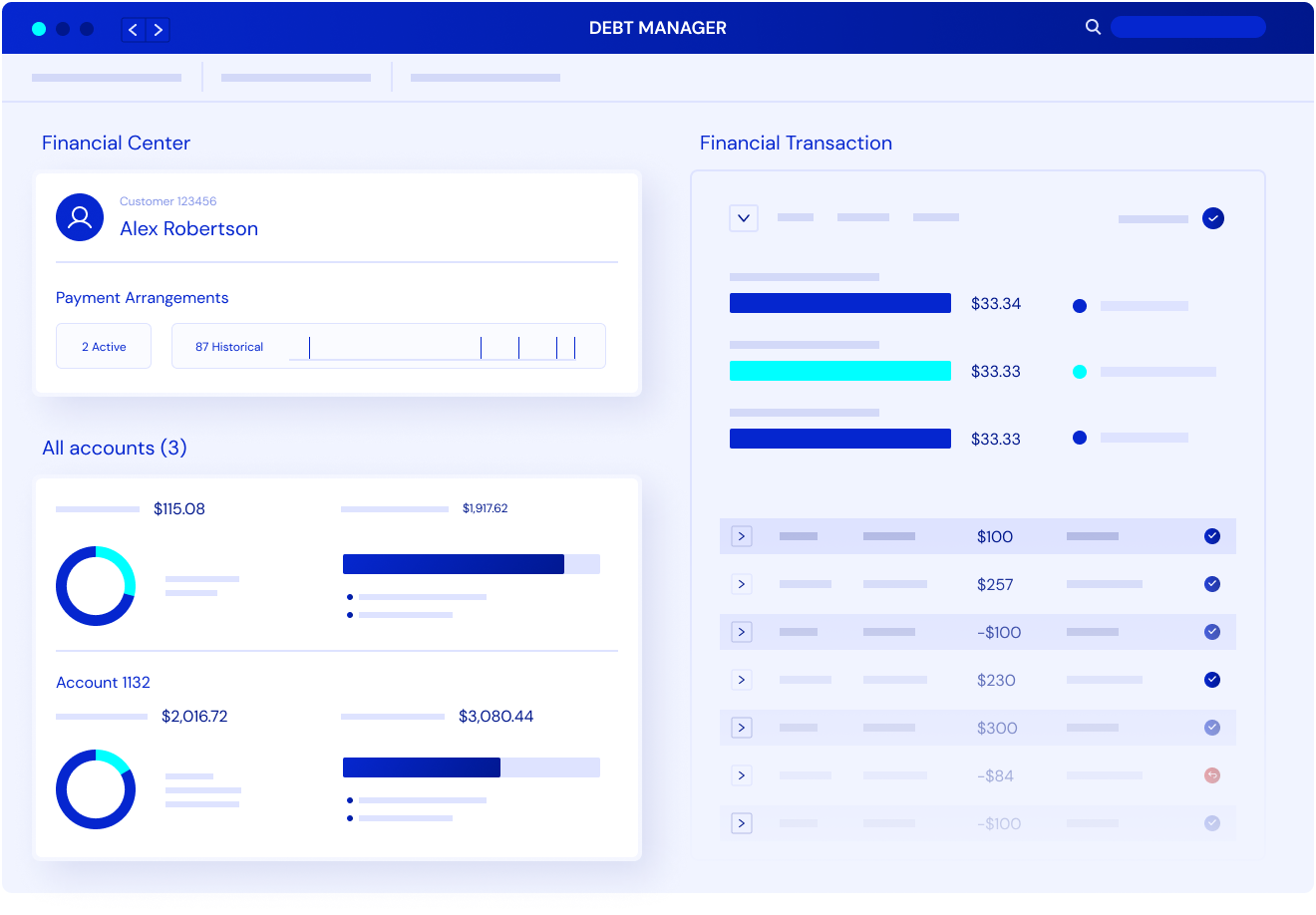

Debt Manager showcases fully configurable data flows so that you have total control over what goes in and out of your systems. Once configured, automation takes over to save you time, money and valuable customer face time.

Inflow: historical customer data for analytics

The first level of Debt Manager’s data flow are those that collect historical customer data from a time before they were delinquent. These flows come from existing host systems that have specific records of events, such as if a customer has faced delinquency before or if it is their first time entering collections.

These historical data flows are vital for the analytical operations of Debt Manager. Analytical models need a base of historical data to make predictions on each customer. From these predictions, Debt Manager’s rules engine segments customers based on their characteristics and likelihood to resolve their debt.

Using this data, you can assign treatment paths to similar groups of customers based on their historical data. Simply put, you can help more customers reach financial stability with Debt Manager doing most of the legwork for you.

Interflow: communications between systems to enhance customer service

One of the most vital elements of customer engagement and service is having up-to-date and efficient systems in place. Vital information, like a customer telling your team they are starting a new job soon, needs to be recorded and integrated into the next steps of their resolution strategy. Without effective data flows, these important communications can easily fall through the cracks.

Debt Manager has a range of integrated data flows between its Single Source of Truth (SSoC) database and specific systems such as its rules engine, chat bot, and your team’s communications. Every point of engagement between you and your customers is recorded and communicated to every system that needs to know.

Whether it’s for omnichannel communication efforts, compliance, creating data-driven strategies or providing the right self-service options, Debt Manager makes sure it’s all up-to-date without adding unnecessary tasks to your IT team’s workload. The result is your customers having a consistent and responsive journey that leads to building valuable brand loyalty.

Outflow: automated data flows to third parties and compliance bodies

When coordinating with Debt Collection Agencies (DCAs), you need real-time data flows between yourself and those collecting debt for your customers. Not only does it provide them with up-to-date data to formulate strategies, but allows you to coordinate appropriate reconciliation in minimal time. Additionally, you also need to have the capability for data flows with external credit bureaus when required.

Debt Manager has full external capabilities when it comes to data flows to third parties. They are fully configurable so that your team can be flexible and adaptable depending on the people that need the data. Not only are they easy to do by your team, but they are cheap to implement and cheap to maintain. Debt Manager saves you time, money and unnecessary effort.

Utilize fully configurable data flows with Debt Manager

Having reliable and responsive data flows are vital to ensuring a consistent, efficient and up-to-date collections experience. They provide your team, systems and third parties with all the information they need to help your customers reach financial stability.

C&R Software’s industry leading debt management collection software showcases fully configurable data flows from host systems, between your own systems and out to DCA’s and compliance bodies. And the best part is that you don’t even need a technical specialist, saving you valuable time and money that you can put back into your customer service.

To find out more about Debt Manager and how its configurable data flows can optimize your collections experience, contact a member of our team today.

-Jan-20-2026-02-48-49-6447-PM.png?width=352&name=operationalize%20AI%20(15)-Jan-20-2026-02-48-49-6447-PM.png)

-Jan-28-2026-02-16-48-0429-PM.png?width=352&name=operationalize%20AI%20(14)-Jan-28-2026-02-16-48-0429-PM.png)